Unlock Credit, Minimize Risk: Smarter Solutions for Agribusiness

Rely on specialized products and services for the agricultural input chain to reduce risks, improve credit flow management, and generate greater liquidity.

Traive’s Solutions for a Stronger Agribusiness

A platform that supports resellers, cooperatives, and agribusiness industries in risk analysis, credit flow management, and receivables negotiation with the financial market.

Gain access to exclusive financing lines tailored to your credit and liquidity needs.

A wide range of credit services for agribusiness, powered by Traive’s technology and expert team.

Comprehensive protection for agribusiness, ensuring security and continuity of operations.

We streamline the journey for all members of the agricultural supply chain with:

Less Risk

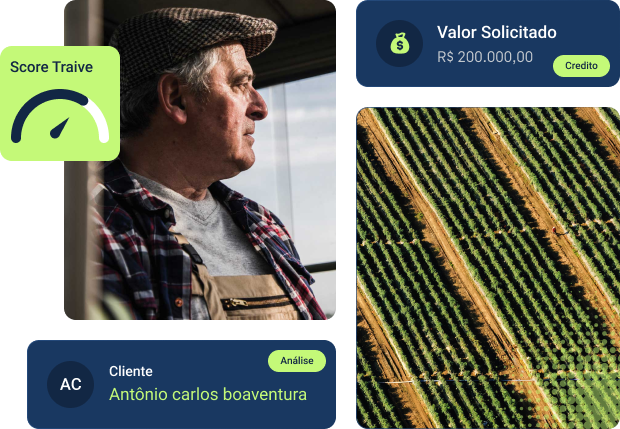

Make accurate risk assessments using artificial intelligence, robust data, and reliable credit scoring. Mitigate risk, reduce defaults, and make decisions with confidence.

Governance

Simplify credit management with an integrated platform that reduces friction and enhances governance across the entire credit lifecycle. Ensure fluidity, traceability, and compliance at every step.

More Liquidity

Advance your receivables quickly and directly with the financial market, unlocking greater access to liquidity and credit availability.

We are the bridge between agribusiness and the financial market

Traive is a technology company that offers products and services to simplify access to credit and investment opportunities in the agricultural sector.

Our proprietary technology transforms complex data into accurate and reliable insights, connecting rural production to the capital it needs to thrive.

Learn more about TraiveTraive Agro

A complete solution to transform agricultural credit commercialization.

Traive Finance

Credit risk analysis and facilitated access to qualified agricultural assets, with full visibility and traceability.

Traive Agro

A complete solution to transform agricultural credit commercialization.

Traive Finance

Credit risk analysis and facilitated access to qualified agricultural assets, with full visibility and traceability.

Check out our blog Fala AI

Where Artificial Intelligence, Agribusiness, and the Financial Market come together.

Como a política de crédito impacta seu negócio no agro

No dinâmico cenário do agronegócio, onde as variáveis são inúmeras e a incerteza faz parte...

Como a política de crédito impacta seu negócio no agro

No dinâmico cenário do agronegócio, onde as variáveis são inúmeras e a incerteza faz parte...

ESG no agro: a sustentabilidade como estratégia de crédito

No cenário atual do agronegócio, a adoção de práticas alinhadas aos pilares Ambiental, Social e...

Dados e inteligência artificial no crédito: o futuro do agro

O agronegócio brasileiro, pilar essencial da nossa economia, enfrenta desafios complexos na gestão e concessão...

Mitigação de risco: ferramentas para reduzir a inadimplência

A concessão de crédito é vital para impulsionar a produção e o crescimento no agronegócio,...

Risco da carteira: como interpretar sua matriz de risco

No dinâmico universo do agronegócio, gerenciar o risco da carteira é mais do que uma...

PT

PT

EN

EN