From credit risk analysis to receivables trading in the financial market

The Traive platform connects financial institutions to opportunities in agribusiness, offering intelligence in risk evaluation and streamlined access to qualified credit assets.

- Traive Platform

Manage your entire agricultural credit flow in one place.

- Our AI

Own models that analyze more than 2,500 variables.

- Risk analysis

Exclusive scores to evaluate producers and agricultural companies.

Intelligent Risk Analysis in Agricultural Credit

Traive offers the financial market a robust and structured credit risk analysis of agricultural companies, powered by proprietary artificial intelligence.

- Analysis of Farmers and Agricultural Companies

- Scores powerd by AI

- Document library

- Dashboards and reports

- Analysis of financial elements

- Travis AI Chat

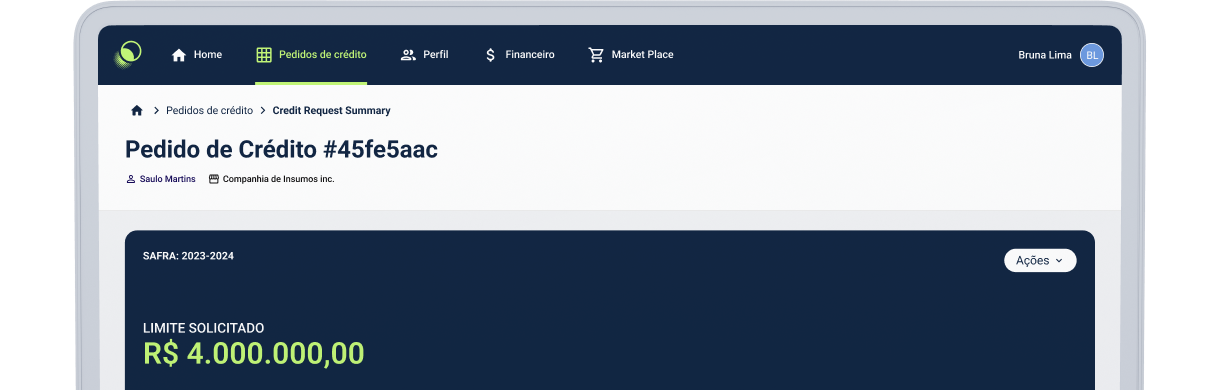

Automated Agricultural Credit Management

Financial institutions use Traive to manage the entire agricultural credit flow with automation, customized policies, and complete visibility. More control, less risk, and scalable origination and management of operations.

- Credit flow dashboard

- Management reports

- Credit routine automation

- Credit policy configuration

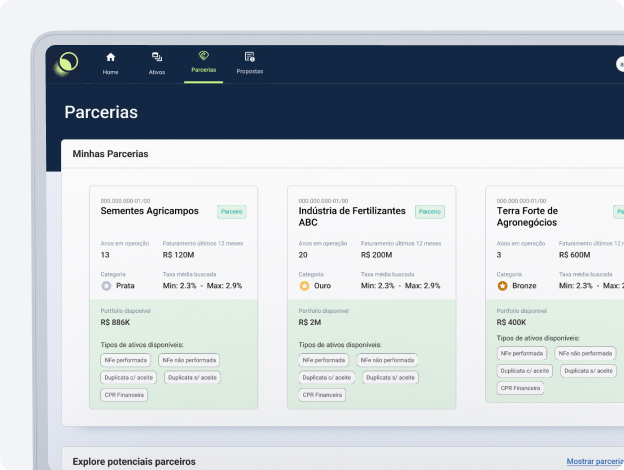

Agile Negotiation of Agribusiness Receivables

Traive connects financial institutions to qualified opportunities in the agribusiness market. Search for and analyze assets, find partner resellers with validated profiles, and send proposals in a secure environment.

- Profile creation and management

- Asset storage and management

- Partnership dashboard

- Proposal management

Synchronize your ERP and increase the power of your credit operation

Features designed to maximize every step of your credit flow

Accurate Risk Analysis

Perform efficient credit assessments and access precise credit scores powered by Traive’s AI.

Less Friction

Receivables management with simplified traceability, scalable structure, and a customizable experience for financial institutions.

Lower Operational Costs

Simplified asset origination that reduces go-to-market time and costs.

Investment diversification

Gain access to a wide variety of qualified assets and investment opportunities.

Discover our success stories

Mais controle e visibilidade na gestão de crédito da Agrícola Kanadá

Com quase 40 anos de tradição, a Agrícola Kanadá fortaleceu sua política de crédito com...

Gestão de crédito ágil e centralizada na Ceres

A Ceres modernizou sua gestão de crédito com a Traive: centralização documental, padronização e decisões...

Mais agilidade e segurança na gestão de crédito com tecnologia especializada no agro

Descubra como a Fertz transformou sua análise de crédito no agro com tecnologia da Traive,...

Gestão de riscos reimaginada por IA: como a Suno otimizou o Fundo Snag 11 com dados inteligentes da Traive

A Suno é uma gestora de recursos com fundos listados em bolsa, como o SNAG11....

AL5 Bank: Tecnologia e inteligência para transformar o crédito rural

O AL5 Bank, do Grupo AMAGGI, atua no crédito para o agronegócio com foco em...

PT

PT

EN

EN